Underinvested, underinsured and over here – China’s wealthy on the move

By Will Grahame-Clarke, 11 Jun 18

China’s private wealth is growing at a break neck pace with four of its eastern provinces as wealthy as Portugal, according to analysis from Legal & General Investment Management (LGIM).

Wealthiest regions

China’s richest coastal regions were five times as wealthy as its poorest inland province in 2017. In European terms, this means that while some of China’s western and central provinces have a GDP per capita similar to or lower than that of Georgia and Belarus, its eastern provinces are as wealthy as Portugal or the Czech Republic.

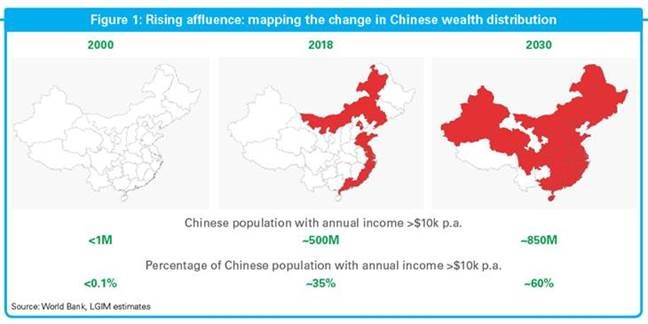

The wealth currently concentrated along the east coast is expected to spread through the rest of China as other provinces also increase their GDP per capita to above $10,000.

Meanwhile, it is also expected that China’s already wealthy eastern provinces will continue to grow wealthier over time.

China’s higher income segment is similar in size to that of the US and the EU, and several times that the size of UK.

The scale of change happening in China is unprecedented. In less than two decades the size of China’s middle class has risen from less than 300,000 to over 500 million. Other growing countries have gone through a similar level change in terms of overall GDP per capita rising over a short period of time, notably Japan between 1960 and 1980 and South Korea between 200 1976 and 1996 .

However, neither can match the sheer size of the middle class being created in China, due to its large population of over 1.3 billion people.

“Much of this wealth is currently uninvested,” said Mazumder. “Asia stands out as a market with the highest levels of cash and deposits compared with other regions globally, as much of this allocation stems from a cultural aversion towards risk.

“The wealth market in Asia is ripe to be institutionalised in our view.”

Tags: China | Legal & General