AMP

Jaw dropping moments from Australia’s Royal Commission

It’s squeaky bum time for senior executives as Australia’s banking, superannuation and financial advice firms face the intense scrutiny of a Royal Commission. Click through the slides below to read some of the incredible moments from the first week of the review into financial advice.

PEOPLE MOVES: SJP Asia, AMP, Arbuthnot Latham

SJP adds two partners in Hong Kong including former Coutts discretionary management head, AMP chief brings forward resignation over lies to regulator and Arbuthnot Latham chief executive steps down unexpectedly.

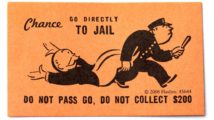

AMP misleading Aussie regulator could bring ‘jail time’

Australian treasurer Scott Morrison says revelations financial services giant AMP intentionally and repeatedly misled the regulator over advice fees charged to its own customers could result in “jail time”, a sentiment echoed by the regulator.

AMP admits misleading Aussie regulator over fees

The group executive of advice at financial services giant AMP has admitted the firm intentionally misled Australia’s regulator over fees, as the Royal Commission into banking, superannuation and financial services targets financial advice.

Bad advice sees Aussie banks pay A$51m

Australia’s five largest banking and financial services institutions have paid a further A$21.4m in compensation to customers who suffered losses because of “non-compliant conduct” by financial advisers, taking the total to A$51.4m (£29m, $41m, €33m). More claims are expected.