Overview

Future challenges

From Disruption to Enlightenment

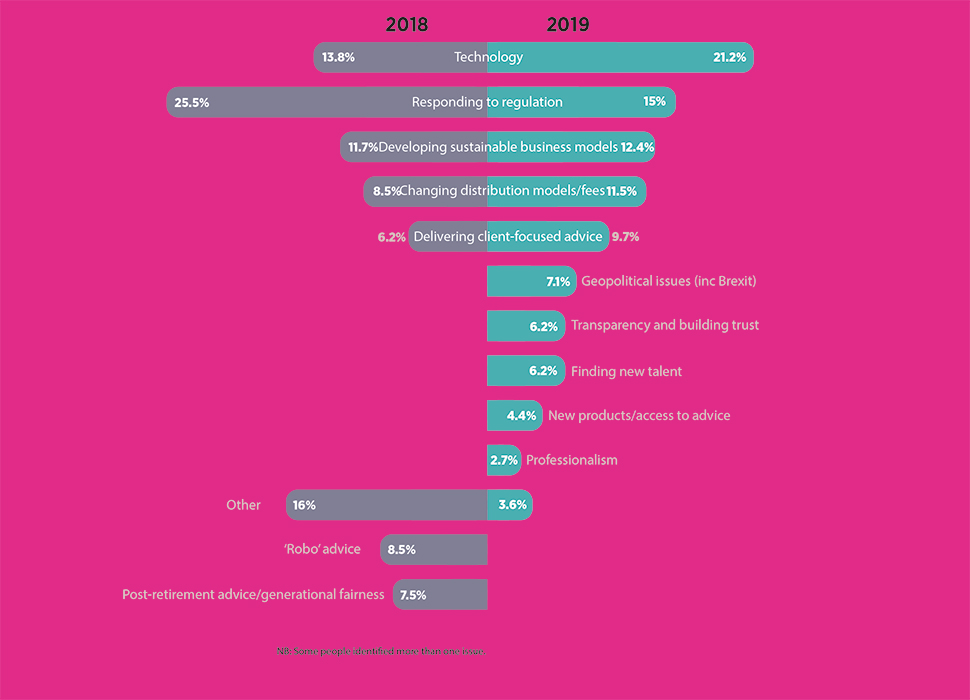

Technology displaces regulation this year as the number one challenge in the eyes of the IA 100 and while it has the potential to cause havoc, it is also key to unlocking the futureClick here to read the article

2018 vs 2019

R&R

Scanning the future

Almost half of the key influencers listed on the following pages identify regulation as the biggest driver of change and an overwhelming majority view it as a positive catalyst for making them fit for future challenges.Click here to read the article

Brexit

Brexit

"The irony is that, thus far, the UK has successfully shaped EU regulation in the way it wants, because it represents such a large part of European financial services, particularly in investment banking and trading. Brexit means it will lose that ability to influence future EU regulation." Dr John Paul Salter, teaching fellow in public policy and management, University College LondonClick here to read the article

Cryptocurrency & Blockchain

Cryptocurrency & Blockchain

"Regulatory uncertainty has prevented cryptocurrencies from penetrating the wealth management industry but the strong demand for information from younger HNWIs is likely to force firms to offer a point of view." Capgemini World Wealth Report 2018.Click here to read the article

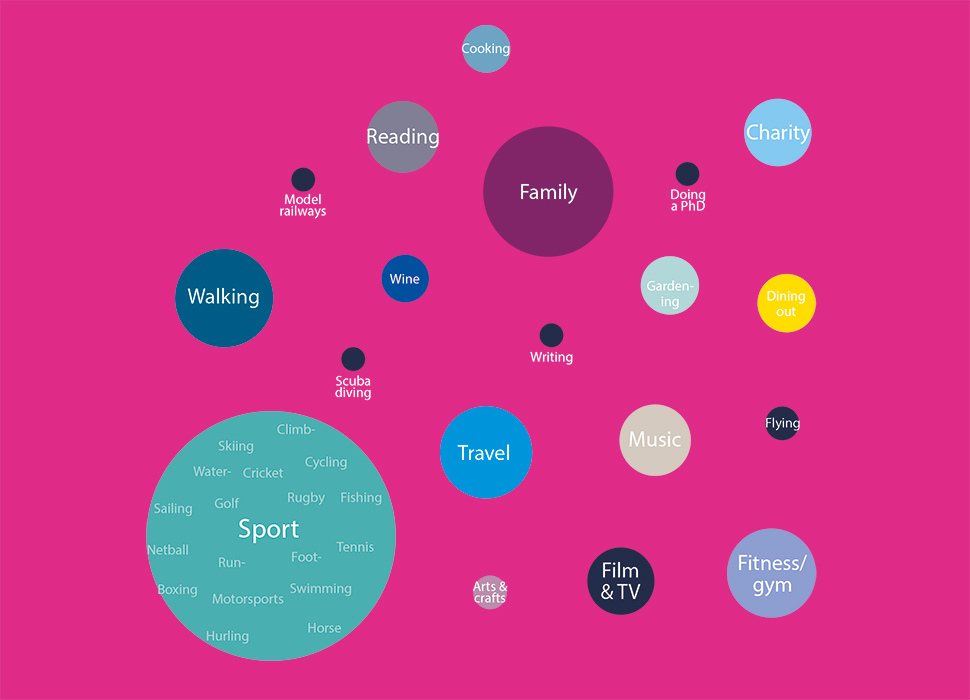

Pastimes

Economic Uncertainty

Global Economic Uncertainty

"Increasingly, in today’s hyper-connected world, much of the uncertainty centres on geopolitical risks. From international trade disputes to environmental regulation and the future of the eurozone, political decisions pose a real threat to both investors and bottom lines." Emily Kuchman and Sean Neary, Edelman Financial Services, WashingtonClick here to read the article

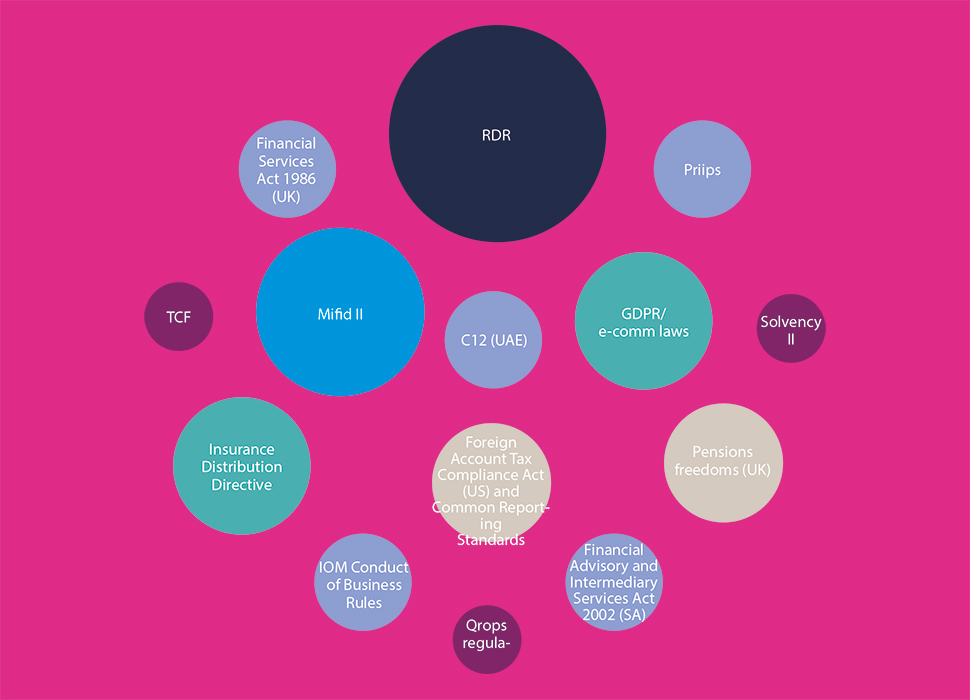

Most influential regulation

Robo-Advice

Robo-Advice

"While established financial institutions have many advantages that allow them to embrace fintech innovation, sensible go-to market strategies and marketing plans are required. And in some cases, firms may find that hot fintech trends are no match for their businesses." Patricio Robles, tech reporter, EconsultancyClick here to read the article

Climate

Climate Change & ESG

"Companies are finding an immediate need to educate their analysts about climate risk and an increasing need to provide client climate risk education as well." Capgemini World Wealth Report 2018Click here to read the article

Years in Current Role

Regional Data