Global wealth surges in 2017 – Credit Suisse

By Will Grahame-Clarke, 15 Nov 17

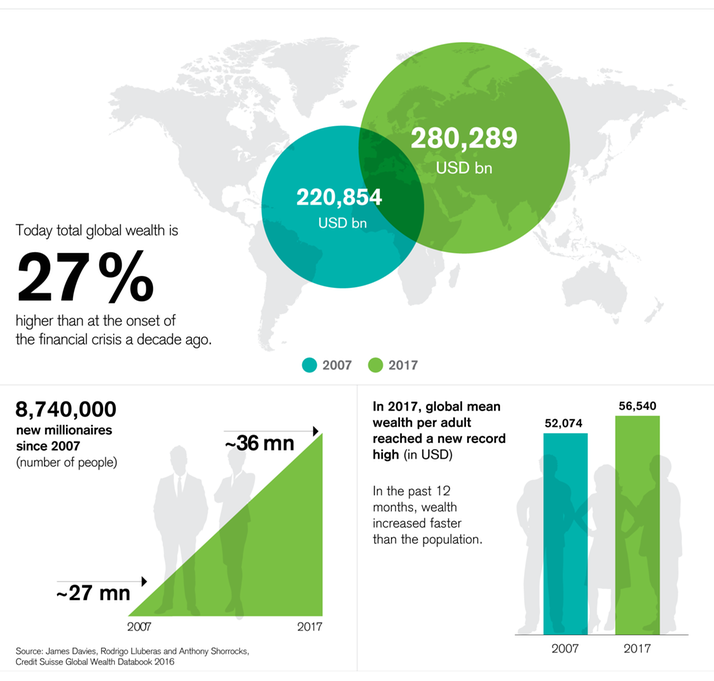

Total global wealth has now reached $280trn (£213.4trn €238.2trn) and is 27% higher than a decade ago at the onset of the financial crisis according to the latest edition of the Global Wealth Report by the Credit Suisse Research Institute (CSRI).

Looking Back

According to the Global Wealth Report, the geographical coverage of wealth growth in the first years of this century was more widespread than ever before.

The upward trends were steady across financial and non-financial asset classes, and regions. Emerging economies were becoming strong global players.

While global mean wealth per adult grew at 7% per year between 2000 and 2007, the bottom half of wealth holders did even better: Median wealth per adult grew at 12% per year.

In 2007, the global financial crisis brought this episode of growth to a halt, wiping 12.6% off global wealth.

Wealth Inequality as Heritage of Crisis

Shortly after the crisis, wealth growth resumed. It has managed to recoup the lost ground and rise further, but the average pace of growth has been less than half the pre-crisis rate.

In the 12 months to mid-2017, significant rises in wealth were evident throughout the world, driven not only by robust equity markets, but also by substantial increases in non-financial wealth. It may signal that we are reverting to the pre-crisis pattern of growth.

The remaining negative heritage of the financial crisis is wealth inequality. It has been rising in all parts of the world since 2007. As calculated by the report authors, the top 1% of global wealth holders started the millennium with 45.5% of all household wealth, but their share has since increased to a level of 50.1% today.

Wealth Outlook for the Next Five Years

According to the report, global wealth should continue to grow at a similar pace to the last half a decade and is anticipated to reach $341trn by 2022.

Emerging economies are expected to generate wealth at a faster pace than their developed peers, and are likely to achieve a 22% share in global wealth at the end of the five-year period. Unsurprisingly, the strongest contribution is expected from China and is estimated at around $10trn, an increase of 33%.

The outlook for the millionaire segment is more optimistic than for the bottom of the wealth pyramid (less than $10,000 per adult). The former is expected to rise by 22%, from 36 million people today to 44 million in 2022, while the group occupying the lowest tier of the pyramid is expected to shrink by only 4%.

Tags: Credit Suisse