Technology is the primary driver of growth. According to the Solow Growth Model, long-term economic growth depends on population growth, capital deepening, and productivity increases driven by innovation, says Marcus Weyerer, Senior ETF Investment Strategist, EMEA, Franklin Templeton.

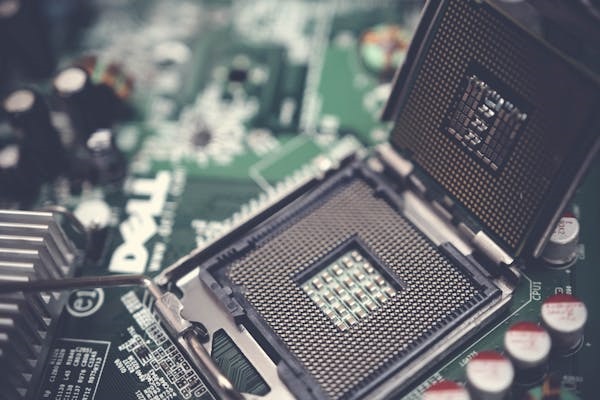

While population growth and capital deepening face diminishing returns, technological progress remains theoretically boundless. Today’s semiconductor industry is at the centre of this progress. These tiny chips are vital in powering all sorts of devices, ranging from smartphones and cars to aeroplanes as well as AI and blockchain applications.

The global semiconductor market, valued at $573.44bn in 2022, is expected to grow at a 12.2% compound annual growth rate (CAGR) and reach $1.38trn by 2029. This growth is fueled by the increasing demand for electronics and advancements in AI. Investors looking to capitalize on future technology trends must understand the complexities of the semiconductor supply chain – and Asia’s dominant role in this ecosystem.

Fragility in the semiconductor supply chain

The semiconductor supply chain is highly complex and concentrated in specific regions, making it vulnerable to disruptions from geopolitical tensions, natural disasters, and capacity constraints. Governments worldwide recognize the industry’s importance, as semiconductors are increasingly becoming a national security issue.

For investors, this presents both risks and opportunities. A regional, ecosystem-based approach offers greater resilience than a purely sector-focused strategy. While semiconductor companies are often viewed as a single group, the supply chain includes diverse roles. Fabless companies like NVIDIA and Qualcomm design chips but rely on foundries for manufacturing. Taiwan’s TSMC and South Korea’s Samsung dominate advanced manufacturing, producing cutting-edge 3-nanometer chips and racing to achieve 2-nanometer technology.

Other key players, such as those in packaging and testing, are essential to the supply chain. Companies like Amkor Technology and Taiwan’s ASE Technology lead the OSAT (Outsourced Semiconductor Assembly and Test) market, ensuring chips are functional and durable. Even small disruptions in these areas can create significant bottlenecks, as seen during the 2021 chip shortage, which impacted various industries, including automotive and tech.

Asia’s semiconductor leadership

Asia has become the world’s semiconductor hub, thanks to lower manufacturing costs and strong government support. Taiwan’s TSMC emerged as a global leader by focusing solely on manufacturing, while US firms concentrated on design. Taiwan’s success today stems from strategic policies in the 1970s and 80s and the emergence of institutions like the Industrial Technology Research Institute (ITRI), which helped establish many leading domestic tech firms.

South Korea’s rise followed a similar path, with government funding enabling heavy investments in R&D and manufacturing. Today, South Korean firms dominate the memory chip market, holding the majority of the DRAM and NAND markets. These chips are critical for high-performance applications, including AI accelerators and supercomputers.

Japan, once a leader in semiconductor manufacturing, shifted its focus in the mid-1990s from high-volume production to specialized products, such as image sensors. While Japan’s share in global chip production has decreased, the country remains a global leader in semiconductor materials, holding over 50% of the market for key components like photomasks and silicon wafers. Japan continues to play a crucial role in automotive and industrial applications, supported by its strong R&D base.

India and China’s semiconductor ambitions

While Taiwan and South Korea lead in high-end manufacturing, other regions are emerging as significant players. India has ambitious plans to become one of the top five semiconductor producers within the next five years. The government’s Production-Linked Incentive (PLI) scheme aims to attract foreign investment, and companies like Tata Group are investing in local chip production. Although India is currently focusing on 28-nanometer technology, which is less advanced, these chips are widely used in energy-efficient applications, such as mobile phones and wearables. India’s robust digital infrastructure and growing middle class position it well for future success.

China, while lagging in some areas, has made notable progress. After the US imposed export restrictions, Chinese firms ramped up domestic production. SMIC, China’s largest chipmaker, recently managed to produce the 7-nanometer Kirin 9000S chip in partnership with Huawei, despite lacking access to the most advanced lithography tools. Although China’s semiconductor technology still trails global leaders, its vast market and government focus on self-sufficiency make it a key player – although it remains less investable.

Technological innovation and investment opportunities

The rapid pace of innovation in semiconductors presents both challenges and opportunities for investors. Moore’s Law, which states that the number of transistors on a chip doubles every two years, is slowing due to physical limitations. However, advanced techniques like 2.5D and 3D stacking, along with new materials, are driving continued improvements in chip performance. Companies like TSMC, Samsung, and Intel are at the forefront of these innovations, essential for applications in AI, data centers, and energy-efficient chips for 5G and quantum computing.

Southeast Asia is also benefiting from the semiconductor boom. Singapore, with its strong infrastructure and skilled workforce, is attracting global semiconductor firms, while Malaysia’s decades-long history in assembly and testing has made it a leader in the OSAT market. The industry contributes 25% to the country’s GDP and Malaysia holds a 13% market share in global OSAT services. Indonesia, meanwhile, is positioning itself in the wider supply chain, particularly in raw materials critical for electric vehicle batteries – the country boasts the world’s largest nickel reserves.

Conclusion: A diversified approach to investing

For investors looking to capitalize on the future of technology, understanding the regional dynamics of the semiconductor industry is critical. Asia remains the center of this ecosystem, with Taiwan and South Korea leading in manufacturing excellence, Japan specializing in high-value components, and India and China rising as key players.

Investing in exchange-traded funds (ETFs) that provide exposure to key regions or countries in the semiconductor ecosystem offers a cost-efficient way to participate in this high-growth market. By leveraging the integrated and combined strengths of various regions, rather than a sector-focused approach, investors can benefit from the technological advancements driving global economic growth.

By Marcus Weyerer, Senior ETF Investment Strategist, EMEA, Franklin Templeton