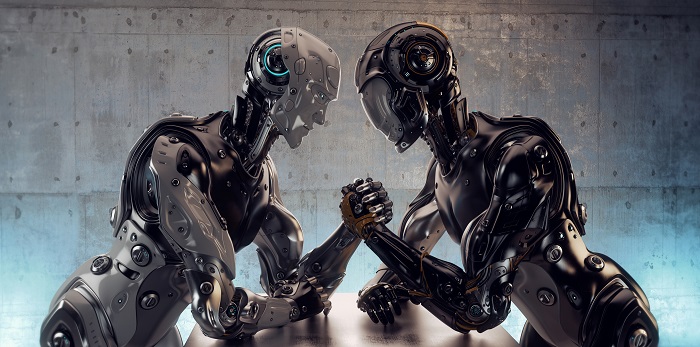

Three Asia focused robo advisers compared

By International Adviser, 8 Aug 18

Three “robos” from the crucible of wealth tech share their data versus benchmarks

Discussion about the rise of robo-advisors has been theoretical – whether they will support or compete with wealth management or more generally disrupt the industry. Views differ, but private banks, asset managers, regulators and investors are all taking robo-advisors seriously.

However, what is missing from the debate is performance. Do the algorithm-driven portfolios actually deliver what they promise?

International Adviser sister publication Fund Selector Asia (FSA) has compared Hong Kong-based Aqumon, Smartly, based in Singapore and Algebra, based in Malaysia.

On July 1, 2018, FSA made a hypothetical investment of $1m (£770,000, €860,000) in each of these three robo-advisors. The results show what that $1m is now worth with return results will be published monthly until August 2019.

The purpose is to highlight the practical angle – how robo-advisers allocate and how they perform, particularly when there is a downturn.

Additionally, self-directed individual investors can make a comparison with their own results, wealth managers can check robo-adviser performance to client portfolio results and the rest of the industry may find the data useful in helping to form a judgement about the robo-adviser phenomenon.

Note: Three portfolios for each robo-advisor are presented – cautious, balanced and aggressive. However, because the firms operate in different markets and offer different products, the robo-advisers are not competing against each other but against their own benchmarks.

Click through the slides to see the results of the first month.

For more insight on asset and wealth management in Asia, please click on www.fundselectorasia.com

Tags: Robo-advice