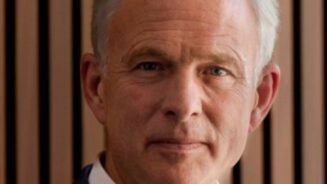

US brokers and investment advisors continue to notify their clients who live in France that they can no longer maintain their accounts and that they must be transferred to another firm, writes Robert Levitt, founder of Levitt Capital Management.

This leads many individual investors who live in France in a predicament, particularly when they have an IRA account. It can be challenging to find another custodian who will accept a French resident.

There is nothing inherently illegal about US custody firms having clients in Europe or France for that matter, but for the investment firm, unless they have a substantial client base there, it probably isn’t worth the time and expense of achieving the necessary compliance requirements suitable for US citizens who live in Europe.

Compliance and regulation is based on where the client lives. So, a French resident, no matter their citizenship, is subject to French regulation as well as European wide regulation. It gets even more complicated for US citizens who live in France, because US citizens are subject to citizen-based taxation, meaning that their investments may be taxed in the US and not their country of residence, as almost every other investor is.

This is not as scary as it might seem as there are more than sufficient investment strategies and custodians open to the US citizen who lives in Europe, but the challenge is sometimes finding those with the knowledge and expertise to navigate both European regulatory rules and US taxes.

Retirement assets, like an IRA, don’t have to be custodied in the US, but there are very few French financial institutions that would be willing to accept the liability that goes with opening such an account. So, when the call or letter comes, the U.S. citizen in France often goes into a panic and they realize that if they don’t find another custodian or investment advisor in a relatively short period, then their accounts will be liquidated to cash causing not only immediate tax liability, but also the potential for a 10% early withdrawal penalty.

Keep in mind that French financial institutions, as most other places in Europe, are primarily dealing with clients who are subject to residence based-taxation (RBT). This means that their focus from both a tax and regulatory perspective is everyone other than U.S. citizens. Hence, they don’t produce the tax reporting needed by Americans nor are they familiar with the constantly changing mix of tax rules that impacts Americans who live abroad.

There are options for US citizens to have any kind of US retirement account while living in France and the number of choices is expected to continue to increase as more US firms see the huge growth potential that Europe represents.

This article was written for International Adviser by Robert Levitt, founder of Levitt Capital Management.