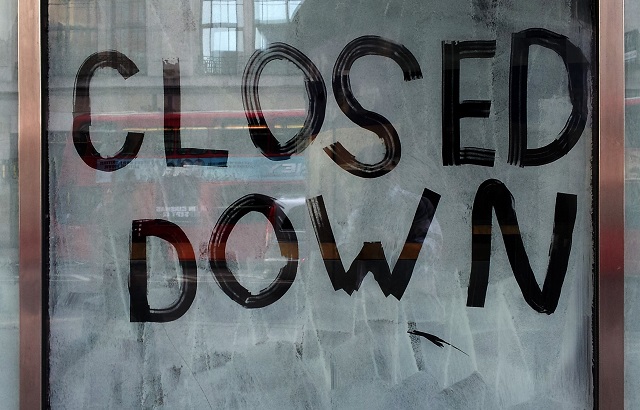

UK-based advisory business Alexander David Securities (ADS) entered creditors’ voluntary liquidation on 1 July 2022, the Financial Conduct Authority (FCA) announced.

As a result, Shane Cooks, Emma Sayers and Malcolm Cohen of BDO have been named as joint liquidators.

ADS had permission to hold and control client money until 29 June 2020 when it agreed voluntarily to the requirements, following intervention by the FCA.

On 29 April 2022, the watchdog took additional regulatory action by imposing a number of requirements including an asset retention order.

ADS is an FCA-regulated firm that was authorised to conduct investment-related activities, and it was also allowed to provide advice via appointed representatives (ARs). It had four ARs.

The firms that are no longer ARs of Alexander David Securities are:

- Beer & Young Limited;

- OS Wealth Management Limited;

- ST Paul Marketing Limited; and

- Templeton Securities Limited.

The FCA said: “The joint liquidators have been appointed to wind up ADSL for the benefit of its creditors and will be writing to all known creditors shortly to explain what this means and how to make a claim.”

The Financial Services Compensation Scheme added that, since ADS has now entered liquidation, the lifeboat scheme has now opened claims against it, and it will be investigating whether clients are eligible for compensation.