I’ve been talking a lot lately in conversations with clients about how much the buyer market has changed over the last 18 months – 24 months, and how those changes have been predominantly led by the increasing number of ‘start-up’ buyers looking to enter the financial planning market in the UK, writes Louise Jeffreys, managing director of M&A consultancy firm Gunner & Co.

In the first quarter of 2021 alone, I estimate more than £385m ($537m, €443m) of private equity money being deployed in the sector, with much more to follow.

Many start up buyers and private equity investors feel there has never been a better time to enter the market, with significant opportunity for returns driven by the stability of financial planning firms and their income streams, the opportunity for growth through new business and market growth and the fast-paced consolidation market.

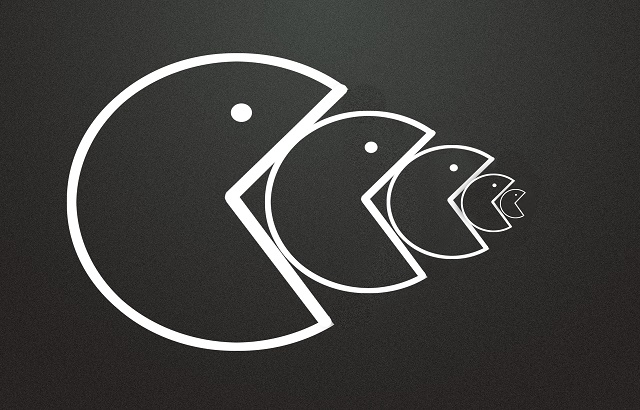

Today, there is a perfect storm attracting these buyers.

Building partnerships

Why does that matter you might say? What’s interesting about these parties is that, by and large, they are looking to build partnerships with already successful firms. They are looking at clean, innovative and entrepreneurial business owners, and offering a number of different elements to deals that weren’t possible in the past.

Investor buyers offer excellent leadership teams the opportunity to take the foundations of quality businesses, and turbo charge them.

Scaling up advisers, clients, and marketing alongside bolt on acquisitions over a five-to-seven year timeframe. Investors are looking to take a journey with business owners, allowing incumbent principals to keep meaningful stakes and share in the growth through future capital events.

An excellent example would be the recent takeover of Skerritts Consultant by Sovereign Capital Partners. Richard Skerritt has long been a regular player in the M&A market, particularly around the South East and South coast.

His deal has allowed him to cash out some of his stake and receive ‘a significant equity stake’ in the new parent company, along with £55m of capital to deploy on bolt-on acquisitions. This will transform their position in the market and open up much bigger deals to them.

Shift

By taking on an equity partner, sub-scale financial planning businesses typically get the benefit of being part of something bigger and more sophisticated, with greater resource, knowledge and experience and often access to funding.

All of which give strategic growth plans significantly more chance of coming succeeding.

And investors are finding lots of willing businesses in which to invest.

In a recent Gunner & Co survey, 36% of respondents said they would like to sell all or some of their business for longer-term succession planning purposes, opening the doors to longer term partnerships – a real shift from retirement being the prime motivation in the M&A sector.

Deals of this nature will be valued on adjusted, or normalised profit, with multiples generally ranging from six-to-10 times.

The typical aim of these ‘buy and build’ strategies is a flotation on the stock exchange, where multiples can reach 15 times – giving the investors a clear and lucrative exit plan.

That said, achieving a listing shouldn’t be under-estimated – much was made of Ascot Lloyd’s failed IPO in 2016, and more recently major acquirers AFH and Harwood have been bought back off the stock exchange by private equity firms. The stock market can take away the agility to raise money and move quickly on further acquisitions.

I’ll be very interested to see how this market shift plays out over the next two-to-three years. It could be that the flurry of deals done now will pave the way for a period of smaller-scale consolidation as these buy and build strategies play out, followed by another peak in activity of the ‘losers ‘of this strategy merge together to get the scale they need to complete their plans.

Ultimately the good news is, there are more and more options for the sellers of good quality businesses, be they large or small.

This article was written for International Adviser by Louise Jeffreys, managing director of M&A consultancy firm Gunner & Co.