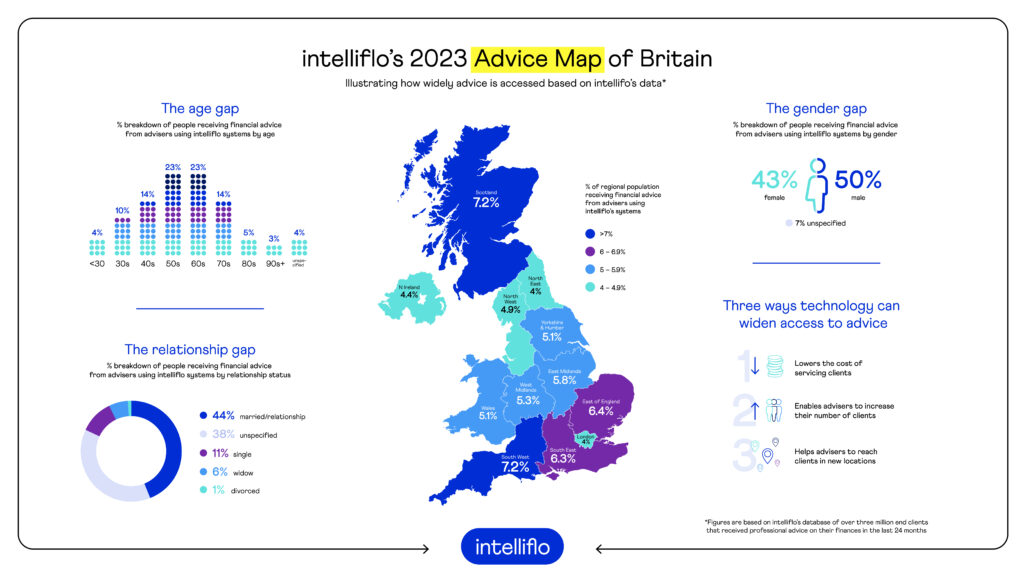

The adviser technology company Intelliflo revealed that financial advice in the UK remains affected by factors such as gender, age, relationship status, and geographic location.

Intelliflo collated data from three million advised clients to create the Advice Map of Britain. This uncovers who is taking advice and who isn’t, and why this is the case.

Age disparities

Findings show that one in five individuals who receive financial advice are British married men over 50.

Over two in three (68%) of advised clients are over 50, while only 14% are in their 40s.

These figures are concerning, according to Intelliflo, as younger demographics would benefit the most from earlier access to advice, especially as life expectancy increases.

Relationship status

Intelliflo’s data suggests that relationship status influences an individual’s openness to financial advice, with 44% of advised clients married or in a civil partnership, while only 11% are single.

Life events associated with marriage, such as having children and buying a house, can prompt individuals to seek financial advice.

To read more on this topic, visit: Nearly 50% of Brits retired without reviewing their finances, survey reveals

Gender disparity

Intelliflo also uncovered a gender disparity in those seeking financial advice.

Overall, 50% of advised clients are male, while 43% are female, a 7% difference between the sexes.

This disparity was most notable in Northern Ireland, revealing 43% female clients versus 54% male. London had the narrowest gap at 47% female and 50% male.

Geographic location

Lastly, Scotland and the South West of England had the highest rates of those seeking advice, each at 7.2%. London and North East England has the lowest proportion at 4%.

To close these gaps, Intelliflo’s chief executive Nick Eatock proposed three ways technology can enhance financial advice.

He said: “Lowering the cost of client servicing: By streamlining financial advice, advisers can enhance efficiency and overall business performance. Intelliflo found that 54% more revenue was generated by tech-embracing advisers.”

Secondly, he added: “Boosting capacity to serve new clients, as high-tech adopters serviced 39% more clients than their low-tech counterparts.

“Reaching clients in new locations: The use of remote servicing expands access to financial advice to wider pool of people.”