There are many over 55s in the UK wondering whether they should tap into their retirement pots, with most saying they won’t touch a penny.

Canada Life surveyed 393 Brits aged 55+ with private pension savings and found nearly nine-in-10 (88%) would not be dipping into their pension this year.

Only 6% said they either had already taken some cash or planned to so do at some point this year, while 6% didn’t know.

Crucial thoughts

Andrew Tully, technical director at Canada Life, said: “It looks like the current economic climate has put the brakes on any plans for people who were looking to dip into their pensions again this year.

“Being pragmatic about the current volatility we are experiencing and thinking ahead is crucial.

“Withdrawing cash when markets are so fluid, more than likely crystallising losses in the process and of course paying tax simply for the money to potentially sit in a bank account, is clearly not sensible.

“Anyone with any doubt about what to do, apart from sit tight and do nothing right now, should definitely consult the services of a professional financial adviser.”

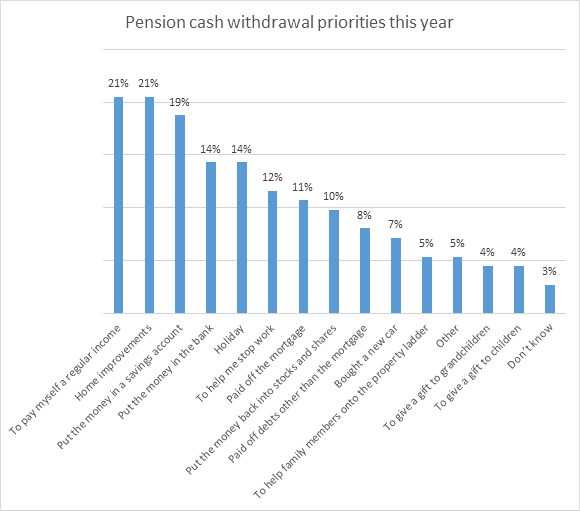

Plans for the money

Of those that said they will withdraw from their pension this year, 21% said they would pay themselves a regular income.

A similar proportion will do so for home improvements, while 19% said put money in a savings account.

Putting it in the bank (14%) and holiday (14%) made up the top five uses for the money.

Source: Canada Life

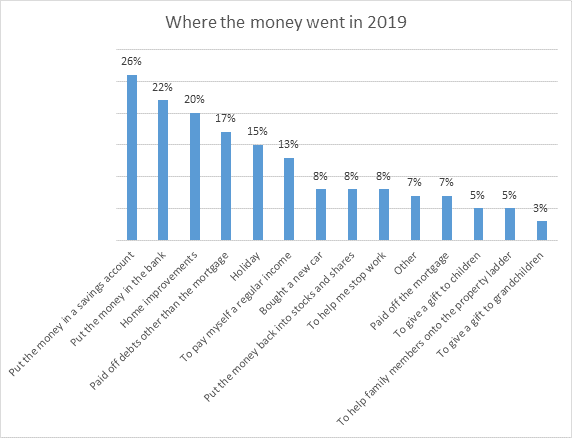

Turn back the clock

The Canada Life research also revealed 20% withdrew a lump sum from their pension during 2019, with the most popular reason for doing so to put the money in a savings account.

Some 25% chose to withdraw on average £18,400 ($22,656, €20,844) to save elsewhere.

People also took money from their pension to put in the bank, with an average of £10,000 being deposited by 25% of respondents in this category.

Making improvements to the home also proved popular for 25%, who withdrew on average £11,600.

The highest value priority for the pension cash was to reinvest the money back into stocks and shares, with just under one-in-10 people choosing to invest on average £34,700.

Paying off the mortgage was also popular with 7%, who used on average £25,500 of their pension to do so.

Source: Canada Life

No surprise

Tully added: “Rather than paint a picture of frivolous spending, the insight shows people are in the main being incredibly diligent and at first glance sensible with their plans for their pension cash.

“This may perhaps come as no surprise given the amount of hard saving required to amass pensions with real value.

“However, simply withdrawing taxed lump sums from a very tax efficient pensions environment to put on deposit or save into stocks and shares makes no sense whatsoever.

“Notwithstanding the fact you’ll likely pay tax on any withdrawals, with the changes to inheritance rules around pensions following the introduction of the freedoms, most people should be leaving their money in the pension until it is required for income or to meet other clear spending commitments.”