The head of business development at financial planner Paradigm Norton has said an Aegon survey is “concerning” after it found many UK baby boomers (aged 55-73) lack confidence and knowledge about where to invest their money.

Aegon, which surveyed 2,000 UK adults, revealed that baby boomers do not know whether their chosen investment strategies will deliver strong returns over the next five to 10 years, with just 3% highly confident that this will be the case.

Those in the baby boomer cohort are unsure about what a good return on investment looks like over the long-term, with one in five (20%) saying they don’t know what they view as a good return on investment over a 10- and 20-year period.

Martin Ruskin, head of business development at Paradigm Norton, said to International Adviser: “This data is somewhat concerning. The impact of inflation over time can seriously damage a person’s (real) wealth, with the last 10 years reducing the value of £1 to less than £0.80.

“The (financial) benefits of ensuring security for short term needs (ie holding cash) coupled with a low cost, well diversified portfolio to maintain (and hopefully exceed) real values for medium to longer term requirements will help to safeguard wealth for future generations to enjoy.

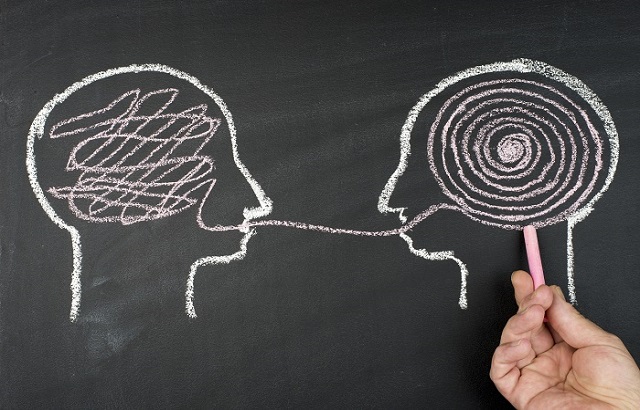

“Ideally, this should be coupled with coaching and education on the necessity for discipline through all economic and investment cycles from both suitably qualified financial planners and the wider investment and wealth management professions.”

Ruskin is also chairman of the CISI IFP Forum.

Further issues with risk

Aegon’s research also found those aged 55+ admit they are highly risk-averse when it comes to investments, with 44% preferring to avoid risk at all costs, compared to 36% of those aged 18-34.

A further 32% of those in the baby boomer age bracket stated that being financially cautious is incredibly important to them, and another 18% said family and friends would describe them as cautious.

In addition, when asked to place their risk appetite on a scale from zero to adventurous, two in five (39%) of over 55s admitted that they have zero risk appetite, with just 17% of those aged 18-34 saying the same.

Some 28% of baby boomers described their risk appetite as low.

Paul Osborn, chief executive for Foresters Friendly Society, told IA: “Being young and taking risks may be two factors which are commonly associated, but getting to the root as to why engaging with investments drops off the older we get, and finding ways to reconnect with ‘baby boomers’ is key – particularly given the balance of wealth.

“It goes without saying that being financially stable is always important given life’s ups and downs.

“If one of the biggest concerns for over 55-year-olds is making misjudged decisions, it’s abundantly clear concentrated support is needed to aid this group, as well as ensuring younger family members are emboldened with healthy investment and saving habits.”

Not understanding investment choices

Aegon was not the only financial institution that highlighted issues for UK investors.

Research from Scottish Friendly found more than 4.4 million UK savers have been put off investing because they find it hard to choose from the thousands of funds on offer.

The firm, which surveyed 2,000 UK adults, found that more than one in three (35.7%) UK adults, who regularly save £100 ($131, €116) a month, said they find the number of funds available confusing and that this has stopped them from investing in the past.

Nearly a third (31.1%) of investors would prefer a choice of fewer than 50 funds, which is far fewer than the 2,000 plus funds available in the market.

DIY investment platform Hargreaves Lansdown whittled its buy list down to 50 from 150 in January 2019.

Lastly, some 65% of those surveyed said that having a guarantee that they would get their money back is more important to them than maximising returns.

Jason Witcombe, financial planner at Progeny Wealth, told IA: “I completely agree with the Scottish Friendly research. The investment world would be a much better place if 95% of the available funds were to disappear. We simply don’t need all of these funds with snazzy names.

“It annoys me immensely if I go to a supermarket to buy a loaf of bread and there is a whole aisle of options, all with confusing pricing offers.

“Personally, I just want to choose between white bread and brown bread. In fact, it has annoyed me so much that I now actively avoid big supermarkets. I would like to be presented with simple choices.

“Choice is all well and good, but it leads to confusion and doubt. It also wastes a lot of time. Most people actually crave simplicity whether it is in their weekly shop or their investment portfolio.”