The Financial Conduct Authority has declared that Anthony George is not a “fit and proper person” and subsequently banned him from performing regulated activities.

The London-based IFA and mortgage intermediary is the director, owner, and sole approved person of 4Life Financial Planning.

According to the regulator, between January 2015 and May 2019, George submitted false information about his income to HM Revenue & Customs resulting in him paying less tax.

Additionally, during compelled interviews with the FCA, George provided information that he knew to be false, which the regulator said “further demonstrated a lack of honesty and integrity”.

Many pies

George had other income streams in addition to 4Life, but failed to inform the accountancy firms in charge of completing his tax returns.

The FCA said he received income from two cash-in-hand businesses – a hair salon and a DJ business – as well as rental income from letting a room in his house.

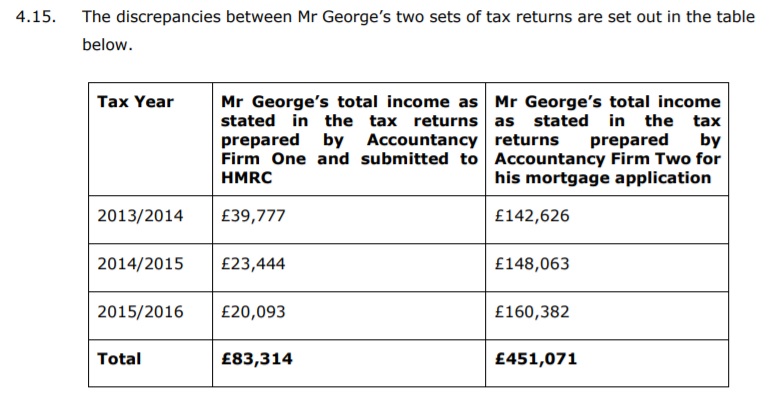

He also appointed a separate accountancy business to prepare an “alternative version of his tax returns which included all of his sources of income for the tax years 2013-14 and 2015-16”, the watchdog added.

It stated that his total income during the period above was some £367,757 ($501,727, €428,022) greater than he had declared to HMRC over the same three-year period.

The higher tax return was used to apply for a personal mortgage worth £630,000.

The lower tax returns were submitted to HMRC and used to claim working tax credits.