After the slowdown of high net worth (HNW) migration into the UK as a result of covid-19, pent up demand saw a spike in the number of UK Tier 1 (Investor) visas issued this quarter, writes Farzin Yazdi, head of investor visa at Shard Capital.

Investor visas, of course, are a visa category where one invests a minimum of £2m ($2.68m, €2.2m) for at least five years in qualifying assets and meets a host of other stringent criteria.

In the most recent figures, nearly 45% of UK Investor Visa applicants originated from mainland China and Hong Kong with applicants from the United States & Russia behind with around 10% of the total each.

Applicants are often attracted to the UK for a variety of reasons – quality of life, the ease ease of doing business with access to the world’s financial centre, the established rule of law and a – comparatively – stable political system, and vitally, the UK’s world class education system.

The current pandemic has highlighted some of the UK’s overlooked advantages, such as its well-developed private healthcare system and geographical positioning ie, ease of doing business with other time zones given the global travel restrictions.

History

Around half the world’s countries have some form of residency- or citizenship-by-investment route called ‘investment migration’. The history of investment migration goes back thousands of years, but in modern day law is still in its infancy and remains a highly political topic.

Countries establish such a route to attract capital and reduce unemployment, for some it has become such a significant part of their economy, for example in the small Caribbean nation of St Kitts & Nevis, investment migration accounts for as much as 30% of GDP.

In the EU, after the 2008 credit crisis, the PIIGS economies as they were called saw an opportunity to begin offering residency by investment or so called ‘golden visas’ to those who invested a significant amount in exchange for the right to reside in their country. Indeed, post-Brexit, the UK population is viewed as the largest new target market for those looking to retire or have a holiday home in these Mediterranean countries.

An ingredient of the UK’s economic success since the mid 90’s has been the UK the Investor Visa category. It highlights to the world that the UK is open for business and welcomes those who have gone through the stringent visa process, arguably one of best and strictest globally, though nevertheless not perfect.

The first step in the visa journey is to engage a UK immigration lawyer or adviser who has the necessary knowledge and experience of the ever-changing immigration system.

Ahead of the departure from the European Union, the UK’s Home Office released over 500 pages of new rules and guidelines around immigration. Indeed, while the Investor Visa category remained unchanged during the latest re-drafting of the rules, it has gone through at least four major changes during the past six years.

Recent numbers

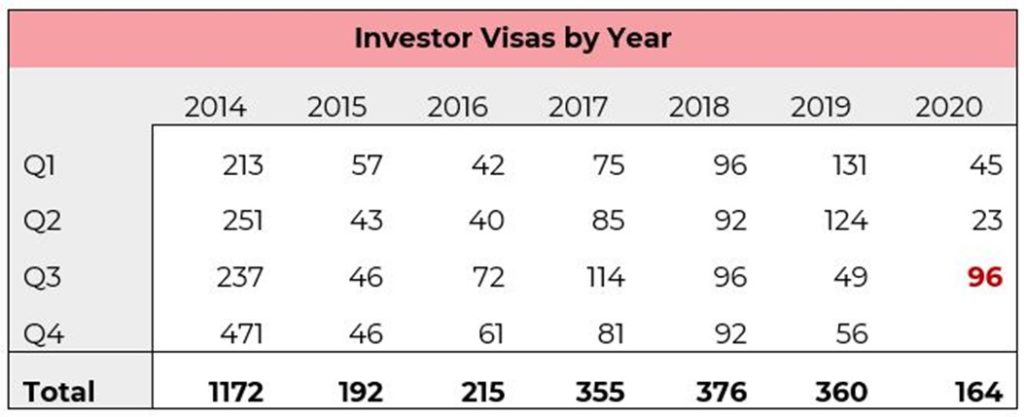

Delving into the numbers, during Q3 2020 showed a total of 96 UK Tier 1 (Investor) visas were issued to overseas main applicants, up from 23 during the previous quarter.

In the UK, there are over 4,500 immigration lawyers and advisers and around 320 Investor Visas are issued each year. One element for issuing the UK’s Investor Visa is for the applicant to have completed the onboarding process with a UK regulated financial institution.

A recent search by Shard Capital showed there are 47 UK regulated financial institutions including some banks advertising the UK Investor Visa.

Source: Shard Capital

Approaching the visa

These numbers demonstrate the scale of appetite for UK Investor Visas – such a marked increase in visas issued this quarter is undeniably worthy of note, particularly against the backdrop of covid-19. With increasing international interest on the visas as a mechanism to enter the UK, it is vitally important, now more than ever, to highlight the importance of finding an expert with experience in this visa category.

While compared to other visa categories the requirements may seem straightforward, in fact the Investor category has many nuances, making this one of the most difficult categories to navigate. The true test for the financial institution and applicant comes at the final stages in year 3 and year 5 of the process.

For international advisers and UK financial services firms alike, there are a host of additional risks with taking on and looking after an investor visa applicant, so much so that some have withdrawn their offering and will not offer an investment account to prospective or existing Investor Visa applicants.

In one example of poor management, a financial firm provided a complex structure which did not operate within the spirit of the law has been brought to task and closed in the meantime, regrettably in turn jeopardising the visas and thus lives of 108 migrants – illustrating clearly the vital importance of experience and reliability.

Some have called for the UK’s financial services regulator to create a separate client classification for Investor Visa applicants given the systems and controls required to be able to meet not only financial but immigration regulatory obligations. The next time you see a potential Investor Visa applicant, do think of the risks involved and call upon those who have stood the test of time.

This article was written for International Adviser by Farzin Yazdi, head of investor visa at Shard Capital.