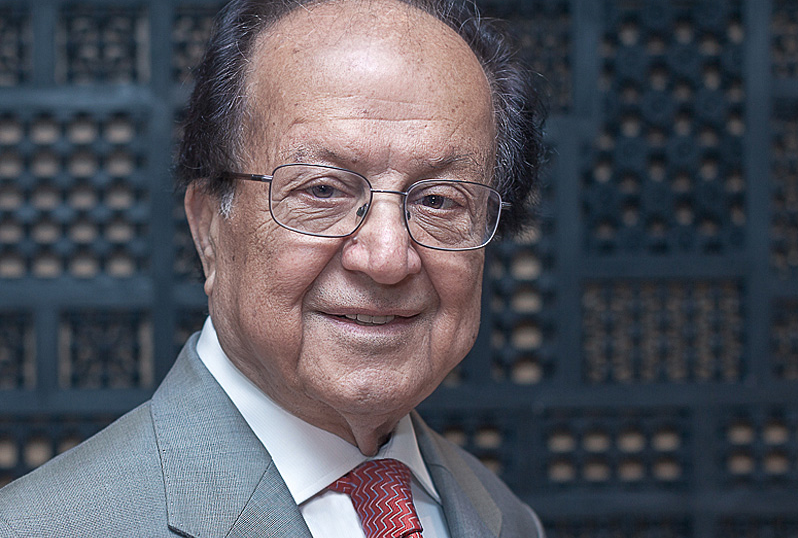

Saleh was a respected financial authority in the UAE who is credited with playing a key role in turning Dubai into an international hub for the financial services industry.

According to local media reports, Saleh died on 6 March after being bed-ridden for several months.

Five decades

Saleh held several high-profile roles in UAE’s financial services sector over a career that spanned 50 years.

Notable roles included governor of the DIFC from 2011 to 2013 and chair of the DFSA from 2007 to 2011, having also served as director of the authority since 2004.

Saleh was a former adviser on financial matters to the ruler of Dubai, Sheikh Rashid Al Maktoum, who is the vice-president and prime minister of the UAE and president of the DIFC.

On his retirement from the DIFC in 2011, Shiekh Rashid praised Saleh’s dedication to serving his country and promoting it as a financial hub.

Saleh started his banking career as a founder of the National Bank of Dubai in 1963. He rose to become the managing director of the firm from 1982 until January 2004.

DIFC

Following on from Saleh’s legacy, the DIFC is currently experiencing high growth in new companies.

On 5 March, the centre reported it had made notable progress towards the delivery of its 2024 growth strategy, which aims to increase the number of active financial firms to 1,000 and the combined workforce of DIFC-registered companies to 50,000.

In 2017, DIFC’s financial services sector grew to 473 firms, and the centre’s workforce increased to 22,338 professionals.

It reported combined revenue of $221m (£159m, €179m) for 2017, which is a similar level of 2016. DIFC’s total assets grew to $3.55bn, a rise of 15% compared $3.08bn the previous year.

(Photo credit: DIFC website)