The number of UK advice companies in the defined benefit (DB) transfer market has been decreasing over the last few years and this shows no sign of stopping, recent research has revealed.

Aegon and Next Wealth surveyed 212 advisers for their report ‘Managing Lifetime Wealth: retirement planning in the UK’ and found the number of firms offering DB transfer advice has dropped sharply over the last 12 months.

The research shows 22% of adviser firms currently provide DB transfer advice, down from 41% in 2020.

This means the proportion of firms in this field has almost halved, down 46% year-on-year, far greater than the 7% fall advisers predicted in the research last year.

In the next 12 months, 36% of firms who currently offer DB transfer advice expect to significantly reduce the volume of such advice, while 9% expect to leave this market.

Reasons

Advisers operating in the DB transfer market have been subject to a number of regulatory interventions, with the Financial Conduct Authority (FCA) seeking to ensure advice is of a consistently high standard.

On 1 October 2020, the FCA banned contingent charging, strengthened its emphasis on recommending a workplace defined contribution pension as the receiving vehicle, and introduced abridged advice.

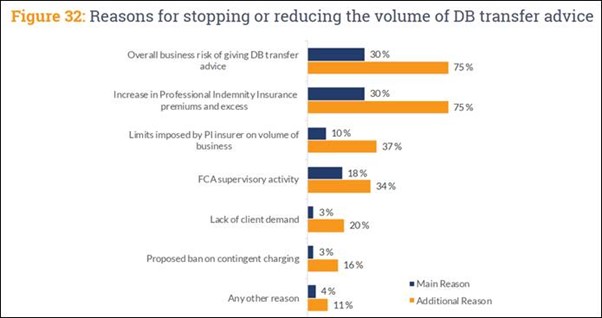

The research also asked firms who have stopped, or who intend to reduce or stop DB transfer advice, to rank the top reasons for this.

Overall, business risk and the increase in professional indemnity (PI) insurance premiums and excess were the top reasons given.

Additional reasons included the FCA’s supervisory activity, with the ban on contingent charging also mentioned by a small minority but not as a major driver.

Source: Aegon and Next Wealth

Abridged advice

The report also showed that 60% of advisers agree that abridged advice is an effective way of identifying clients where a transfer is not suitable, an increase from 46% last year.

However, only a third (34%) agrees that abridged advice with the requirement for a full fact find will save sufficient time and be suitably priced to attract potential clients.

Of those firms offering DB transfer advice, just over half (51%) are already offering abridged advice.

Around one in three (31%) advisers who provide abridged advice say they offer it for free. Of the two-thirds (66%) who charge for this, most offer the service for less than £1,000 ($1,383, €1,160).

‘Life-changing opportunity’

Steven Cameron, pensions director at Aegon, said: “While the FCA has noted improvements in the market, we have seen a worrying and very sharp reduction in the number of firms providing this advice over the last few years.

“Over the last 12 months, the numbers have almost halved.

“What’s particularly concerning is the rate of firms exiting the market while the demand for such advice remains high. The research highlights an acceleration, with the number of firms exiting far exceeding adviser predictions.

“Over the last year, our research shows this has been driven by general business risks, PI cover challenges and FCA supervision activities.

“Some had predicted the ban on contingent charging would also have been a significant factor, but only 3% of advisers cite this as the main driver for exiting.

“Similarly, only 3% say the main driver is lack of client demand. This sets alarm bells ringing as we need to make sure the ongoing supply of advice meets demand or people will be unable to explore their statutory right to transfer.”

Failure to meet demand

Cameron continued: “General business risk coupled with PII challenges has led to a fall in the supply of DB transfer advice, and there’s a real risk supply will fail to meet demand.

“It’s encouraging, however, that there is positivity around the use of abridged advice to identify those for whom a transfer is unlikely to be suitable.

“Abridged advice can’t conclude transferring is the right thing for a client, but it can indicate where it is clearly not the right thing to do, helping clients avoid paying unnecessarily for the full advice process, as well as avoiding using up advisers’ scarce time unnecessarily.

“We hope the FCA keeps a close eye on the ongoing supply of DB transfer advice to ensure this stays sufficient to provide an effective market.

“It’s important individuals have the opportunity to explore transferring which while for many will be unsuitable, for others could offer a life-changing opportunity.”