The introduction of the Senior Managers & Certification Regime (SMCR) is intended to increase transparency and accountability within the UK financial services sector.

But, during the transition to this model, financial advisers and advice firms could have to deal with a greater administrative burden.

This is because, from 9 December 2019, the Financial Conduct Authority (FCA) has stopped updating its register which is going to be replaced by a directory at the end of 2020.

Solo-regulated firms, which fall under the purview of the FCA but not the Prudential Regulation Authority (PRA) have until 9 December 2020 to submit information under the SMCR.

This means that the status of some financial advisers on the FCA register could appear as “regulatory approval no longer required”.

Arguably, this makes things more confusing for clients and potentially also the firms working with those advisers.

The move has prompted Prudential UK to start asking the advisory firms it works with to self-report their regulatory status.

A spokesperson for Prudential UK told International Adviser: “Due to the recent changes to the Financial Services Register, and to make sure that we continue to accept business instructions only from appropriately authorised advisers, we are now asking adviser firms to let us know directly when advisers start or leave their business.

“As the Financial Services Register will no longer accurately show individual adviser data, we believe that this is likely to become standard practice across the industry.”

Do your homework

The FCA stressed to International Adviser that fitness and propriety should always be assessed regardless of changes in registers or regulation.

It said: “Consumers should always check the register to see if the firm they are dealing with is authorised by us.

“It is the responsibility of senior managers to ensure that the firm assesses the fitness and propriety of certain key staff, such as financial advisers, at least annually. The FCA will hold senior managers and firms to account for doing this effectively.

“If consumers want to check the status of an adviser, they should first check that the firm they work for is authorised and then contact the firm using the contact details on the FCA register.

“The firm can let them know about the current status of the adviser. We are making consumers aware of this change when they search the register.”

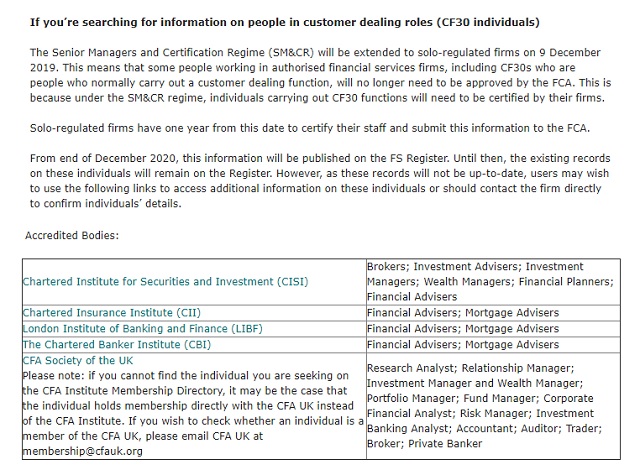

The following message now appears on the FCA website:

Best practice should suffice

The Personal Finance Society (PFS) believes the transitional period is not going to burden financial advisers at all, because firms will remain listed on the register and their status will be updated.

It will only be the single individuals, not in senior managerial roles, who won’t be listed or have their information refreshed regularly.

Keith Richards, chief executive of the PFS, told IA: “The Senior Managers & Certification Regime was introduced to ensure that firms understood they are accountable for ensuring regulated advisers and staff are fit and proper.

“Regulated firms are listed by the FCA for consumers to check, but individual advisers are no longer listed on a central register until a new one becomes available at the end of 2020.

“It is worth remembering that individual regulatory registration has never been in place for professionals like insurance brokers.

“So, the challenges and risks presented by the changes to the FCA register are no different for financial advisers than they are for insurance brokers and other intermediaries, and it is believed the previous register was more often used by firms rather than the public.

“As a result, the costs for firms in terms of due diligence, are unlikely to increase significantly, provided they continue to manage risks in an intelligent way as they have been doing with insurance brokers and other intermediaries.

“That said, in a world of increasing scams and fraudsters pretending to be regulated professionals, a central register would be a tool for the public to gain a greater degree of confidence to engage the sector,” Richards added.

Time lapse

The Chartered Institute for Securities and Investment (CISI) echoed these sentiments, as it claims the industry is happy to self-report.

It does recognise, however, that this will put an administrative burden on firms in the short term.

“Our feedback from the profession on this is that: first, they are happy to directly authorise the advisers in their firms – realistically they were doing all the checks to do that anyway and they would rather have that responsibility directly as it is their name and reputation on the line when advice is given.

“So, from that perspective there isn’t much more of a burden,” it told IA.

“Second, where the increased burden does lie is in the issue of training and supporting other staff and the allocation of different roles within the regime.

“Overall, whilst there is an increased burden especially in the short term; they expect, and hope, that in the long term it will lead to better outcomes for consumers and reduce the regulatory burden overall on their firms.

“Time will tell if it is good enough. Firms may be able to help by listing their advisers on their websites and linking to the relevant accredited bodies registers.

“From 9 March 2020, the new directory will show details of those under the certificate regime for banks and insurers; whilst the solo-regulated firms’ details will not appear until 9 December 2020.”

Problem still persists

But individual firms claim they would still need to boost their administrative efforts to deal with the situation; which, of course, comes with a cost.

Louise Dunstan, head of training and competence at Sandringham Financial Partners, told IA: “For advisers, firms have until December 2020 to issue a certificate, or not, but the new directory may not be up and running until around March 2021; which means that where an adviser doesn’t get certified, the wider industry would have no oversight on this until the directory is published.

“Firms are asking us, as advice networks, to verify individuals. While this does take time, it is better to do this than risk a fraudster being given an opportunity to sneak in through the back door and, given that the senior managers can be held accountable, it’s better to be safe than sorry.

“While SMCR is positive for all concerned, it is firms who are most disadvantaged in terms of time and cost needed to implement and adhere to the regime, however we need to remember the objective of SMCR is ‘to reduce harm to consumers and strengthen market integrity’.

“Anything that helps the industry become stronger can only be a good thing.

“Yes, it is an additional administrative task, but we have to be sensible and realise it is for the short term,” she added.

To each their own

But one issue advice firms are facing is how to manage the year-long vacuum, as there is no standardised way to deal with it.

While Prudential is asking advice companies to self-report, tax advisory business Lewis Brownlee decided to take a different course of action.

The firm’s financial services director, Ian Barnett, told IA: “The self-reporting issue was something we discussed at our recent team meeting. We discussed whether we should be on the front foot on this and proactively contact the companies we use and confirm the authorised status of our advisers.

“But we decided against this and will do any requested authorisation, piecemeal. It is likely to be an additional burden, as we are likely to be asked to evidence that our advisers are authorised.

“But I suspect that there will be no consistent approach adopted by all companies. We could be asked to self-certify or we may have to send copies of Statements of Professional Standing or something else entirely.

“Experience tells us, sadly, that had we tried to be proactive about this, it’s likely the evidence we would send would either be ignored or would have be to resent in a specific format to satisfy each company’s own requirements.”

Consumer danger?

Some argued, however, that the lack of up-to-date information could create favourable grounds for fraudsters to operate.

Lewis Brownlee’s Barnett added: “The FCA register still lists the business and the principals, albeit not the individual advisers.

“There might be a risk to clients, if fraudsters try to exploit the adviser status vacuum.

“That said; when we see clients, they very rarely have ever looked at the FCA site to see if we as a business or as advisers are ‘registered/authorised’.”

Sandringham’s Dunstan agrees, since not many clients are familiar with or even use the FCA register.

“This very much depends on how many consumers actually checked, or even knew about, the FCA register in the first place,” she added.

“My guess would be very few. SMCR has been big news in the financial press, however, I would speculate that if you asked 50 random people on the street what SMCR is and how it affects them as consumers or the industry as a whole, very few would know.”

But the CISI said that this “is likely to cause a little confusion for consumers seeking advice”, regardless of the number using the register or of those familiar with the regime.

Dunstan said: “Of course, there is always an opportunity for a fraudster to take advantage given the ‘right’ circumstances, however this is nothing new – these risks have always been there.

“The opportunity, however, lies with advisers out there to not only improve and nurture their digital footprint, but also to educate their clients on key regulation, why it’s important, and shouting about it when they obtain their certification telling them why this is such an important milestone.”